Sign up for MarketBeat All Access to gain access to MarketBeat's full suite of research tools:

Prudential Financial Inc. trimmed its stake in shares of West Fraser Timber Co. Ltd. (NYSE:WFG - Get Rating) by 15.5% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 9,750 shares of the company's stock after selling 1,788 shares during the period. Prudential Financial Inc.'s holdings in West Fraser Timber were worth $709,000 at the end of the most recent reporting period. 18mm Brown Film Faced Plywood

A number of other large investors also recently modified their holdings of WFG. EverSource Wealth Advisors LLC bought a new stake in West Fraser Timber in the second quarter valued at approximately $49,000. Lazard Asset Management LLC acquired a new stake in shares of West Fraser Timber during the 2nd quarter worth about $114,000. SG Americas Securities LLC acquired a new stake in shares of West Fraser Timber during the 3rd quarter worth about $159,000. Moors & Cabot Inc. increased its position in West Fraser Timber by 8.4% during the first quarter. Moors & Cabot Inc. now owns 2,525 shares of the company's stock worth $208,000 after acquiring an additional 195 shares during the period. Finally, Advisor Group Holdings Inc. increased its position in West Fraser Timber by 15.0% during the first quarter. Advisor Group Holdings Inc. now owns 2,632 shares of the company's stock worth $217,000 after acquiring an additional 344 shares during the period. 45.74% of the stock is currently owned by institutional investors and hedge funds. Analysts Set New Price Targets

Several research firms have commented on WFG. Raymond James lowered shares of West Fraser Timber from a "strong-buy" rating to an "outperform" rating in a report on Monday, October 24th. Credit Suisse Group boosted their price target on shares of West Fraser Timber from $95.00 to $97.00 and gave the stock an "outperform" rating in a research report on Monday.West Fraser Timber Price Performance

NYSE WFG opened at $82.82 on Wednesday. The company has a market cap of $6.73 billion, a PE ratio of 3.53 and a beta of 0.96. West Fraser Timber Co. Ltd. has a 52 week low of $68.75 and a 52 week high of $102.96. The company has a quick ratio of 2.21, a current ratio of 3.36 and a debt-to-equity ratio of 0.06. The firm's 50-day simple moving average is $77.29 and its two-hundred day simple moving average is $80.11. West Fraser Timber Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Friday, January 13th. Stockholders of record on Friday, December 30th were issued a $0.30 dividend. This represents a $1.20 dividend on an annualized basis and a dividend yield of 1.45%. The ex-dividend date of this dividend was Thursday, December 29th. West Fraser Timber's payout ratio is 5.11%. About West Fraser Timber (Get Rating)

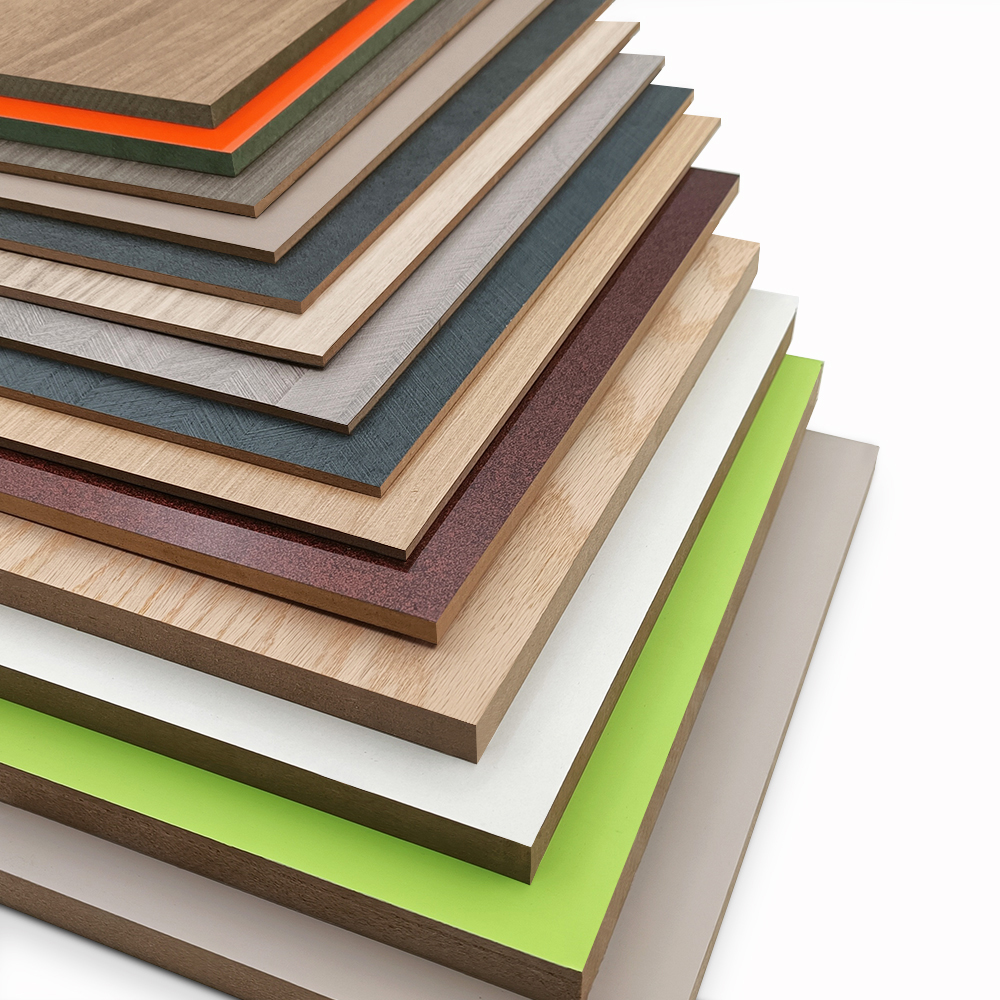

West Fraser Timber Co Ltd. is a diversified wood products company, which engages in producing lumber, engineered wood products (oriented strand board, laminated veneer lumber, medium density fiberboard, plywood, and particleboard), pulp, newsprint, wood chips, other residuals and renewable energy. Its products are used in home construction, repair and remodeling, industrial applications, papers, tissue, and box materials.Featured StoriesGet a free copy of the StockNews.com research report on West Fraser Timber (WFG)LCI Industries Diversification Strategy Pays OffIs It Time To Buy The Dip In The Coca-Cola Company Ex-Dividend Date vs. Record Date: What’s the Difference?How Does the Consumer Price Index Affect the Stock Market?Are Denny’s Corporation Investors Due For A Grand Slam?

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider West Fraser Timber, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and West Fraser Timber wasn't on the list.

While West Fraser Timber currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Sign up for MarketBeat All Access to gain access to MarketBeat's full suite of research tools:

View the latest news, buy/sell ratings, SEC filings and insider transactions for your stocks. Compare your portfolio performance to leading indices and get personalized stock ideas based on your portfolio.

Get daily stock ideas from top-performing Wall Street analysts. Get short term trading ideas from the MarketBeat Idea Engine. View which stocks are hot on social media with MarketBeat's trending stocks report.

Identify stocks that meet your criteria using seven unique stock screeners. See what's happening in the market right now with MarketBeat's real-time news feed. Export data to Excel for your own analysis.

326 E 8th St #105, Sioux Falls, SD 57103 contact@marketbeat.com (844) 978-6257

© American Consumer News, LLC dba MarketBeat® 2010-2023. All rights reserved.

Concrete Mould Plywood Panel © 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided 'as-is' and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart's disclaimer.